It was just over five years ago that companies were enticed by the business-friendly climate in Mexico, and the generally positive affect that the ruling PRI (Institutional Revolutionary Party) party was having

on manufacturing and foreign direct investment.

The runaway election of Andrés Manuel López Obrador (who is better known by his acronym AMLO, and hailing from the Morena party) in 2018 and his subsequent policy changes to improve the plight of the working class changed everything, however.

AMLO campaigned on his commitment to raise the minimum wage by at least 15% year-over-year. And he has kept true to his promise, with minimum wage increases ranging from 15% to 23% each year.

And the wages in border states rose even higher. For example, the 2023 minimum wage for border states is MXN$312 Pesos per day, while across the rest of Mexico, the wage is pegged at MXN$207 Pesos per day.

Effect on Foreign Direct Investment

Adjacent to this, in response to inflation, Mexico’s central bank raised interest rates faster than the US Federal Reserve did. High interest rates (12%) drove up the peso. These two factors combined drove up

the cost of labor for businesses investing and manufacturing in Mexico by 4.3%, according to the Center for Economic Studies of the Private Sector (CEESP). Overall, CEESP reported that labor costs in Mexico rose by over 40% since 2018, disproportionate to the overall rise in operational costs, making businesses weary of further investment into Mexico.

Jose Medina Mora, President of business chamber Coparmex, suggested that potential investors from Canada, Germany, Spain and the USA are holding off on estimated investments of as much as US$35 billion until Mexico does more to improve the country’s investment climate.

It’s no secret that Mexico’s manufacturing sector has continued to boom as more companies grew weary of the high costs of production in China (supply chain delays, rising costs, IP theft, etc.) and sought an alternative.

Mexico benefited tremendously from its USA proximity. Nearshoring gives companies the upside of low labor costs with short supply chains, making their production process seamless and extremely profitable. However, there are many implications that affect the profitability of these business ventures, and one of the most volatile in recent years has been labor costs.

Factors to Consider

But a large dose of context is important. Wages in Mexico may be rising by nickels; but wages in the USA are going up by dollars. The average wage for a manufacturing worker in the USA in July of 2023 was

US$26.47; in Mexico it was US$3.80 (both figures from Trading Economics).

Even if the wages in Mexico were to double, companies manufacturing in Mexico will still realize significant cost savings when compared to the alternatives.

Tangentially, the future of the economy and politics in Mexico is uncertain. And although the minimum wage in Mexico is expected to continue to increase, in part due to inflationary pressure, the political landscape is due for a change. The presidential election in 2024 will bring about a new president, which will also affect wage policies and business practices for the following five years.

2024 Presidential Election

The current Mexican Administration, led by López Obrador of the Morena political party, has developed and executed policies that many categorize as antagonistic toward business and foreign investment.

The two other most influential political parties are the PRI and the PAN (National Action Party), and they both seem to be economically austere in their choices. The PRI lands between center and center-right spectrum, promoting privatization of state-run companies and closer relations with the Catholic Church as well as embracing free-market capitalism.

The PRI maintained nearly absolute power over Mexico for most of the 20th century. And PAN, the party of former President Vicente Fox, is more conservative comparatively and supports free enterprise, privatization and thus free trade agreements.

However, the predictions are heavily favoring the Morena political party to win again in 2024, and Andrés Manuel López Obrador will play a significant role in choosing the candidate to be his successor. Even

after the election, there may not be significant change in the policies toward private business investment.

An August 2023 poll published by El Universal and reported by Reuters showed former Mexico City Mayor Claudia Sheinbaum holding a double-digit lead in the leadup to represent Morena in 2024. Morena is heavily favored to win the June 2024 election, and AMLO enjoys high personal approval ratings.

In view of these politically uncertain times, pressures from inflation and currency appreciation, the investment sector is choosing the Mexico-based ventures wisely. There are some sectors that should feel relatively secure in their investments.

Manufacturing companies with low capital investment production are going to be less affected by these changes and will still be able to benefit from many of the upsides of Mexico investment. Although labor costs are going up, the overall gains outweigh these costs when looking at the savings in supply chains and labor costs.

Desirable Long-Term Interest in Mexico

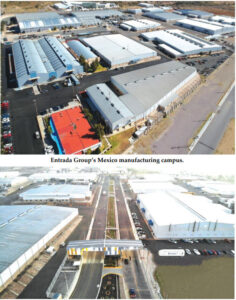

The long-term interest in Mexico as a desirable nearshore production hub remains strong. One way to mitigate risk in Mexico is to partner with a shelter company like Entrada Group that has a long, proven

track record in Mexico; see Entrada’s campus images below.

Entrada Group’s manufacturing support platform handles all nonproduction-related necessities in Mexico including workforce, import and export, compliance, customs and legal entity. Despite the rising operating costs in Mexico, the future remains rosy for wire harness producers and other manufacturers.

www.entradagroup.com

Article can be found in the Wire & Cable Technology Sept/Oct 2023 Issue.